How Homewood Insurance Keeps Finding Better Coverage at Lower Prices

In insurance, pricing doesn’t stand still. Markets harden. Carriers exit. New underwriters enter. Appetite shifts. Risk models change.

In insurance, pricing doesn’t stand still. Markets harden. Carriers exit. New underwriters enter. Appetite shifts. Risk models change.

And yet, despite all that volatility, we’re consistently finding better coverage at lower prices for our clients.

Recent examples:

- Sexual Abuse & Molestation (SAM) coverage at $2,500 — compared to the more typical $3,000+ rate.

- Specimen collector professional liability coverage at $1,500 — significantly lower than the rate the client had previously been paying.

So what’s happening? Are new markets emerging? Are rates softening? Or are we simply getting more efficient?

The answer is: all of the above — strategically.

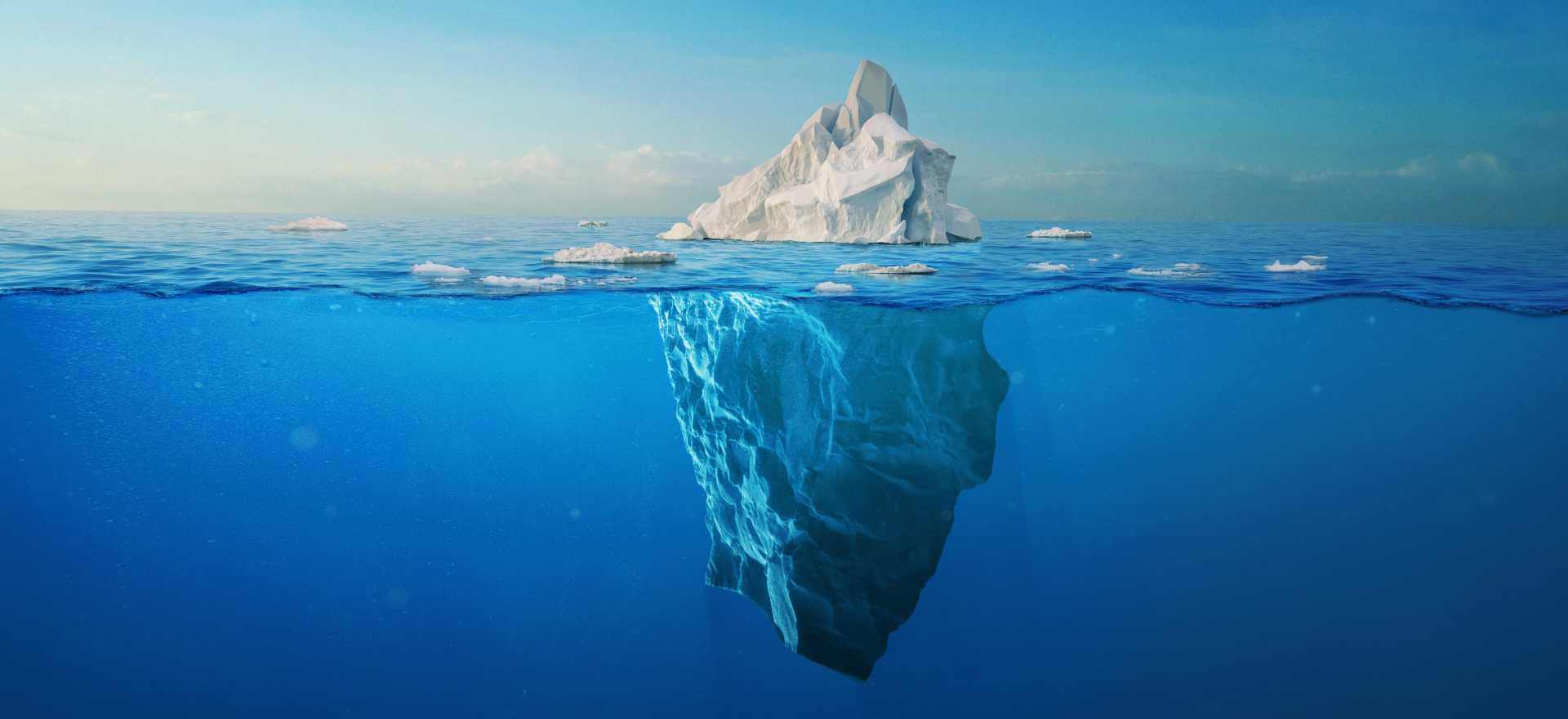

The Insurance Market Is Fragmented — and That’s an Opportunity

Healthcare liability insurance is not one unified marketplace. It’s fragmented across:

- Standard admitted carriers

- Specialty medical professional liability carriers

- Surplus lines markets

- Niche program administrators

- Captive-style or affinity-based programs

Many brokers only access a small slice of this universe.

At Homewood, we work with nearly 100 carriers, and we continuously monitor:

- New entrants to the healthcare liability space

- Carriers expanding appetite into niche risks

- Program administrators launching targeted underwriting initiatives

- Regional carriers quietly adjusting pricing strategy

New markets are emerging — particularly in specialty healthcare niches. But unless you are actively looking for them, you won’t find them.

Why We’re Seeing Better Pricing in Some Areas

1. Targeted Underwriting Is Replacing Blanket Pricing

Carriers are becoming more sophisticated. Instead of pricing entire classes as “high risk,” many are now:

- Using better actuarial data

- Narrowing underwriting criteria

- Rewarding clean claims histories

- Offering better terms for properly documented risk management

That’s how we secured:

- Lower SAM coverage pricing

- Significant savings for a specimen collector with a clean operational history

When risks are clearly presented — and properly positioned — some carriers compete aggressively.

2. We’ve Become More Surgical in Our Market Targeting

Over time, we’ve refined:

- How we present applications

- Which carriers we approach for specific risks

- How we position exposures before submission

- When to avoid markets that are likely to overprice

This isn’t just “shopping around.”

It’s understanding carrier psychology and appetite alignment.

For instance, a specimen collector might be overpriced in a general healthcare program — but priced far more competitively in a diagnostics-focused niche market.

3. Some Hard-to-Place Risks Are Stabilizing

Areas like Sexual Abuse & Molestation coverage were extremely difficult markets several years ago. Now we’re seeing:

- More structured underwriting guidelines

- Better risk segmentation

- More competition among specialty carriers

That doesn’t mean rates are falling across the board — but it does mean opportunities exist for well-managed organizations.

Transparency: Why We Regularly Update Our Website With Real Costs

Many insurance websites publish outdated or vague pricing ranges.

We don’t.

We regularly update our pages with:

- Current premium benchmarks

- Realistic cost ranges by state

- Market movement trends

- Risk factors that influence pricing

Why? Because educated clients make better decisions.

And when medical and social services professionals come to us, they deserve clarity — not guesswork.

The Real Competitive Advantage: Access + Insight

Better coverage and lower pricing don’t happen by accident.

They happen when:

- You have broad carrier access

- You monitor market shifts constantly

- You understand underwriting appetite

- You position risk intelligently

- You revisit pricing annually

We don’t assume last year’s rate is still the best available.

We test the market.

Every year.

The Bottom Line

Yes, new markets are emerging.

Yes, underwriting sophistication is improving.

Yes, competition exists in certain niches.

But the real difference is this:

We actively look for opportunities others don’t.

If you’re a healthcare provider or organization that hasn’t tested your insurance pricing recently, you may be paying more than necessary — or missing out on stronger coverage terms.