Self-Funded Health Plans

What is a Self-Funded Health Plan?

A self-funded health plan is an alternative to traditional group insurance where your organization takes direct control over healthcare benefits for your team.

Instead of paying fixed monthly premiums to an insurance carrier, your facility sets aside funds to pay for employees’ healthcare claims as they arise.

This approach can provide greater flexibility, transparency, and long-term savings, especially for healthcare and senior living organizations that understand the importance of balancing costs with high-quality employee benefits.

Why Healthcare & Senior Living Organizations Choose Self-Funding

Your employees are the backbone of your operation. Attracting and retaining dedicated caregivers, nurses, and support staff requires offering competitive benefits. Self-funding allows you to:

-

Gain More Control – Customize plan designs to match the unique needs of your workforce..

-

Reduce Costs Over Time – Avoid paying large insurer profits and overhead; keep the savings when claims are lower than expected.

-

Improve Transparency – Access detailed claims data to identify cost drivers and manage health trends in your team.

-

Flexibility in Coverage – Include benefits often excluded from fully insured plans, such as mental health resources, wellness programs, or telemedicine.

-

Cash Flow Advantage – Unlike fixed premiums, funds are only paid when claims occur.

Who needs Professional Liability Insurance?

Any professional working in medicine should have professional liability coverage in today’s climate of uncertainty, particularly with juries increasingly handing out generous awards to injured parties. The potential for lawsuits and financial damages is much higher in the medical field than other industries.

This is true for general medical professionals like physicians and physicians assistants. Executives like medical directors should also be covered as their decisions impact on a large number of people and affect the actions of medical professionals in their team.

Specialists like phlebotomists, respiratory therapists, surgical technicians, optometrists, pharmacists, and imaging technicians should have professional liability cover, as they can be sued for actions taken in the course of their duties.

Professionals working in the field of psychological and mental health, including psychologists, psychotherapists and mental health technicians should also have professional liability cover, as should those working in alternative medicine, including massage therapists.

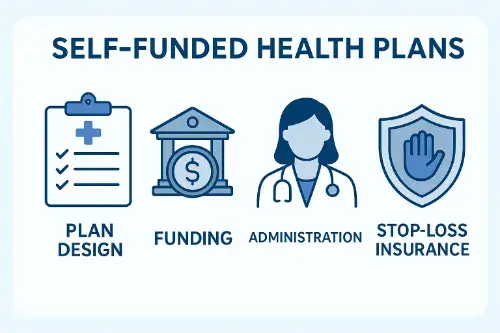

How It Works

- Plan Design – Your organization, with guidance from our experts, designs the benefit plan.

- Funding – The employer allocates money into a dedicated health claims fund.

- Administration – A third-party administrator (TPA) manages claims processing and compliance.

- Stop-Loss Insurance – Protects your organization from catastrophic claims by setting a cap on maximum exposure.

Get a Quote Now

Fill out the form and we'll get you a fast quote on your insurance.

Is Self-Funding Right for Your Organization?

Self-funding works best for healthcare and senior living organizations with:- 50 or more employees (though smaller groups can participate with the right structure).

- A commitment to employee wellness and preventive care.

- Leadership willing to engage in data-driven decision making.

Partner With Experts in Healthcare Risk & Insurance

Self-funding can feel complex, but the right partner makes all the difference. At Homewood Insurance, we specialize in helping healthcare and senior living organizations transition to self-funded health plans. From evaluating feasibility to implementing stop-loss protections, we’ll guide you every step of the way..

What our customers say

Speak with an Insurance Professional

Call 216-502-4967 or

Fill Out the Form

Michael Richards

Michael specializes in setting up Self-Funded Health Plans. You can call him or fill out the form and he will get your message directly.